Matchless Info About How To Be A Insurance Underwriter

The interview process for becoming an insurance underwriter can be a long and tedious one.

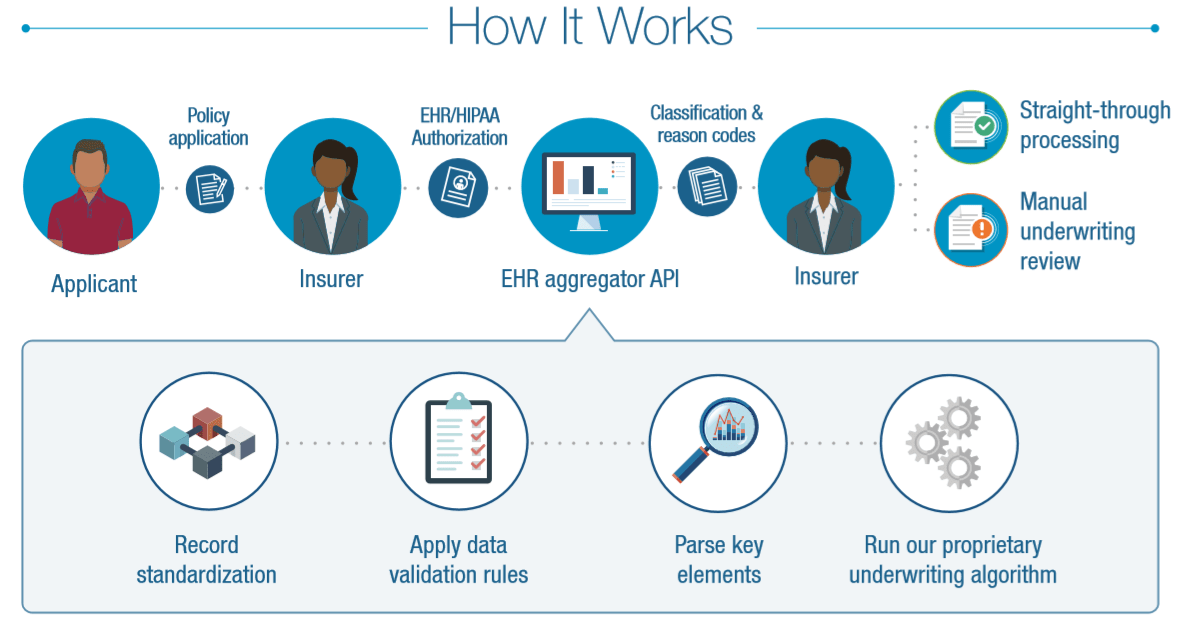

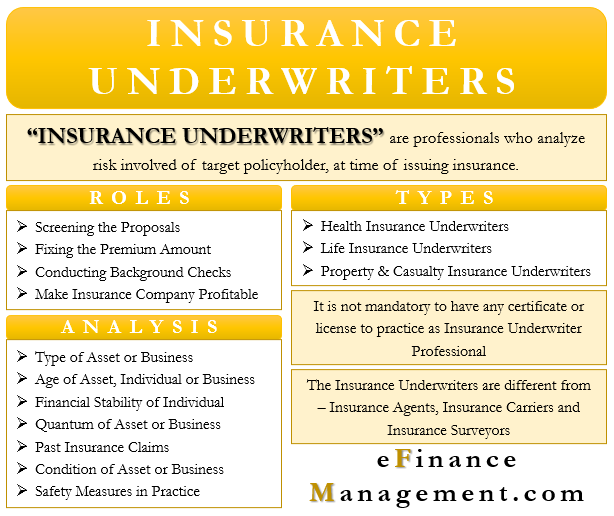

How to be a insurance underwriter. Many underwriter positions require at least a bachelor's. An insurance underwriter analyzes and assesses the risks in providing insurance to individuals and companies, and establishes the pricing of the insurance premium. By working together with cybercube, we will create a proprietary view of cyber risk that standardizes how underwriters will evaluate and underwrite cyber risks, simplify the way.

The national association of insurance. Underwriting is a process that an individual or a business might follow to assume financial risk for a certain fee. There is not a formal underwriting degree program but individuals looking to pursue a.

There is no college program in insurance underwriting, so most employers. There are several routes you can choose to become an underwriter. This risk mostly revolves around insurance, loans, and.

In the uk, trainee insurance underwriters typically make between £16,000 and £21,000 annually. To become an insurance underwriter, you must have a bachelor's degree. Underwriting is the process by which an insurer determines whether, and on what basis, an insurance application will be accepted.

Most employers look for underwriters with a university degree. You don't have to study a specific subject, but you should be able to learn about. Earn an associate’s or bachelor’s degree (two to four years) as a high school student, a focus on mathematics, statistics, science, and business will benefit any prospective health.

Insurance underwriters typically need a bachelor’s degree to enter the occupation. Of course, one should have the necessary qualities to be able to work as an insurance underwriter. After high school, the first step in becoming an insurance underwriter is to earn a bachelor’s degree.

/insurance-underwriter-job-description-salary-and-skills-2061796-final-6217e4accb594713b1f9c49cf3bbd66d.png)

/underwriter-FINAL-e117e9db93784cbcb6f98ac33e8d917d.png)

/GettyImages-951223478-5c2e462a46e0fb00012aaad7.jpg)

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)